The majority of the year saw the S&P 500 (SNPINDEX: \GSPC) reach new highs; but, in recent days, the index has experienced a rather large decline. Since its peak in mid-July, the index has dropped by about 9%, putting it perilously close to correction territory, which is defined as a down of at least 10% from an index's top.

For months now, a lot of investors have been concerned about a decline, and this most recent decline has made many of them anxious. To be honest, no one can definitively determine if a more serious market collapse is about to occur. You're not alone, though, if you're worried about investing at the moment. Therefore, is it truly safe to make investments in the market at such erratic a time as this? Or should you wait for the market to stabilise before acting? The solution is not as complicated as it seems.

To what extent does market volatility matter?

Image Source: Twitter

Even experienced investors find the market volatility intimidating. Regardless of how long you've been investing, it's difficult to see the value of your portfolio decline. The good news is that, despite the possibility of a more severe slump, volatility isn't as important as you may assume.

The secret to making the most of your stock market fortune is to have a long-term perspective. Even though the value of your assets may decrease when stock prices decline, you don't lose money unless you sell. Your portfolio should rise if you just stick to your stocks until the market rebounds, and you'll probably end up exactly where you started without losing any money.

Based on past performance, there's a strong likelihood that this will occur because the market has a remarkable history of rising following downturns. In actuality, the market has always weathered crashes, bear markets, and corrections.

Timing the market vs. time in the market

Image Source: Twitter

Marguerita Cheng, CEO of Blue Ocean Global Wealth in Gaithersburg, Maryland, and a licensed financial adviser asserted that the length of your investment tenure matters more than the timing of your investment. That's also a proverb to keep in mind at the moment.

In an email interview, Cheng stated, "The best way to build wealth is to stay invested, but I know that can be challenging."

Investing just for long-term objectives makes things simpler. You don't invest money that you might need to in the next five years since there's a good chance the stock or mutual fund you buy will lose value quickly. You could have to sell your investment before it has an opportunity to recover, which would result in a loss if you require those cash for a significant purchase or an emergency.

However, you shouldn't be too concerned about such temporary declines if you're investing for the long run. Your ability to meet your long-term financial objectives, such as retirement, will come from your compounding profits over time.

Bonds and fixed-income investments are examples of more cautious investments that can be used for shorter-term financial objectives. While they frequently climb far less than stocks during bull markets, they are typically more resilient against stock market downturns. Your asset allocation, or how your portfolio is divided between riskier assets like stocks and safer investments like bonds, may be adjusted to meet various objectives over a range of periods.

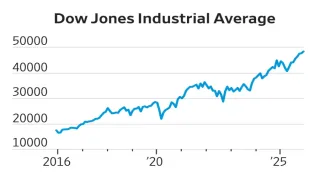

The S&P 500's current performance

Image Source: Twitter

The present S&P 500 decline may seem terrible at the moment. However, if you look at the index's history, you can see that it has overcome far more adversity and emerged stronger than before.

Furthermore, data indicates that, in terms of the S&P 500's historical returns, if you're a long-term investor, there has never been a terrible moment to purchase. Upon reviewing the index's rolling 20-year total returns, Crestmont Research analysts discovered that all of those intervals concluded with gains.

This indicates that regardless of when you invested, you would have had positive returns if you had invested in the S&P 500 (for example, through an S&P 500 index fund or ETF) and held it for 20 years.

The bright side for investors

Market downturns may not always be pleasant, but one benefit is that they can present excellent buying opportunities. Purchasing during a market surge may be highly costly; but, as prices are starting to decline, now is the ideal moment to get premium stocks at a reduced cost.

Once more, there might be more market declines. However, the likelihood of losing money on your assets is much lower if you retain them for the long term. You may purchase your stocks for less money by "buying the dip" and weathering the storm, and you will still profit when the market eventually turns around.

But you have to make sure you're buying quality stocks. Weak businesses might find it difficult to recover from economic upheaval, which could be expensive if they fail. However, organisations that are in good health have a much higher chance of being able to withstand difficult times. When these stocks are trading at a discount, you may buy them in bulk and profit handsomely later on.

Although market volatility might be concerning, the correct approach will maximise portfolio protection. You may not only weather this downturn, but prosper from it if you maintain composure, keep your money in the market, and use this chance to buy high-quality equities.

Which stocks are good to purchase now?

When the economy is volatile, certain equities do better than others. However, index funds are a better option for most people to consistently invest in than picking individual stocks.

What is the precise process for introducing dollar-cost averaging into the market? Combining this with stock funds, such as exchange-traded funds, is a popular tactic.

You might establish automated investing into an ETF through your online broking account or retirement account on a monthly, weekly, or bimonthly basis to dollar-cost average. You would benefit from diversification and dollar-cost averaging with this method, which is a hands-off technique meant to create long-term wealth.

Also Read: Why is the Indian stock market going down?