The Indian stock market ended Wednesday's session on a subdued note, with benchmark indices showing limited movement. As the focus shifts to Thursday, key factors are set to dictate the market's direction, including global cues, economic data, and technical trends. Here's a breakdown of the 10 critical factors that will influence market action:

1. US CPI Data Impact

The U.S. Consumer Price Index (CPI) data released on Wednesday aligned with forecasts, with annual inflation at 2.7% and core inflation at 3.3%. These figures solidify expectations of a potential Federal Reserve rate cut. Declining U.S. bond yields, particularly the 10-year Treasury yield falling to 4.21%, may support equity markets globally, including India.

2. India Inflation Data

All eyes are now on India's retail inflation data, which will provide crucial insights into domestic price pressures and potential Reserve Bank of India (RBI) policy adjustments. Higher-than-expected inflation may weigh on investor sentiment.

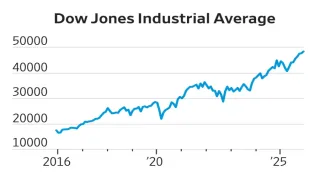

3. Global Market Trends

- US Markets: U.S. stocks rallied after the CPI data, with major indices like the S&P 500 and Nasdaq gaining ground. Megacap stocks, including Tesla and Amazon, led the uptrend.

- European Markets: European indices also recovered, with the STOXX 600 closing 0.3% higher, indicating improving global risk appetite.

Positive cues from global markets are likely to spill over into Indian equities, particularly in sectors like IT and consumer discretionary.

4. Technical Setup for Nifty and Sensex

Technically, the market remains non-directional, as noted by Shrikant Chouhan from Kotak Securities. Key levels to watch include:

- Nifty: Resistance at 24,700 and support at 24,500.

- Sensex: Resistance near 81,700 and support at 81,000.

A breakout above these levels could trigger fresh buying, while a breach below support may lead to selling pressure.

5. FII and DII Activity

Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) have played a pivotal role in market trends. Monitoring their net investment will provide insight into capital flows. Sustained FII inflows can drive indices higher, while outflows may limit gains.

6. Sectoral Trends

- Metals: Optimism over China's potential stimulus measures has boosted metal stocks. Watch for continued momentum in this space.

- FMCG and Pharmaceuticals: Defensive sectors like FMCG and pharma saw gains on Wednesday, signalling cautious investor sentiment.

- IT and Consumer Discretionary: These sectors gained traction on positive global cues and are likely to remain in focus.

7. Most Active Stocks

In terms of turnover, stocks such as Titagarh Wagons, Axis Bank, and Reliance Industries were the most active on Wednesday. Meanwhile, Vodafone Idea and IRFC topped the volume charts. Traders will closely track these counters for potential breakouts or corrections.

8. Stocks at 52-Week Highs

A total of 272 stocks hit their 52-week highs on Wednesday, including:

- Swan Energy

- Jubilant Ingrevia

- Vedanta

- Kaynes Technology

A strong trend in these stocks indicates bullish sentiment in specific sectors.

9. Buying and Selling Pressure

- Buying Interest: Stocks like Jupiter Wagons, PNC Infratech, and Ircon International showed significant buying interest, signaling potential upside.

- Selling Pressure: On the other hand, counters such as ITI Ltd, Mahindra Lifespace, and PNB Housing faced profit booking, which may continue if selling intensifies.

10. Sentiment Meter

On Wednesday, market sentiment remained neutral, with 2,084 advancing stocks outpacing 1,902 declining stocks on the BSE. Positive sentiment in global and domestic markets could swing the meter further in favour of bulls on Thursday.

Also Read: Godrej Consumer Shares Crash 10%: Is It the Right Time to Buy?