The Pakistan Stock Exchange (PSX) has taken many by surprise as it continues to defy the broader economic struggles faced by the country. Recently, the KSE-100 index soared past the 90,000 points mark in intra-day trading, marking a record-breaking surge. This bullish trend has left analysts and investors alike questioning the underlying factors contributing to such an extraordinary performance in a time of economic turmoil.

Key Drivers Behind the Market Surge

Several interconnected factors have played a pivotal role in the current stock market rally, highlighting the unique dynamics at play in Pakistan's financial landscape.

A significant catalyst for the current upswing is the recent approval of a $3 billion loan from the International Monetary Fund (IMF). This funding aims to stabilize Pakistan's economy and is expected to bolster investor confidence. The IMF Extended Fund Facility (EFF) provides a safety net for the country, reassuring both domestic and foreign investors of a commitment to economic reforms and stability.

Expectations of Interest Rate Cuts

Analysts have pointed out that expectations of a policy interest rate cut by the State Bank of Pakistan (SBP) are driving market momentum. The anticipation of a 200 basis points reduction, marking the fourth consecutive cut since June, is seen as a means to stimulate economic growth. Lower interest rates generally encourage borrowing and spending, which can lead to increased business activity and consumer confidence.

Attractive Valuations in Key Sectors

The price-to-earnings (P/E) ratio of stocks in Pakistan remains notably low compared to other emerging markets, offering considerable room for growth. Miftah Ismail, a former finance minister, noted that many companies were trading at valuations that effectively discounted potential risks, including economic downturns. This situation creates a favourable environment for investors seeking undervalued stocks, particularly in sectors such as oil, gas, banking, and cement.

Sectoral Performance Driving Growth

Widespread buying activity has been observed across various sectors, contributing to the market's upward trajectory. Key sectors experiencing significant gains include:

- Oil and Gas Exploration: Companies like Oil and Gas Development Company (OGDC), Pakistan Petroleum Ltd (PPL), and Pakistan State Oil (PSO) have reported substantial stock price increases, driven by both local and international market trends.

- Banking: The banking sector is also seeing improvements, with many institutions trading below book value just a year ago. These discounted valuations are now rebounding as economic stability returns.

- Cement and Construction: As infrastructure development continues, the cement industry is benefiting from increased demand, further fueling stock market performance.

Macro-Economic Indicators and Investor Sentiment

Despite the stock market's strong performance, macroeconomic fundamentals remain precarious. Economists caution that while the market is experiencing a rally, underlying economic issues persist. Javed Hassan, an economist, pointed out that growth projections for the next couple of years are likely to remain below 5 per cent, according to IMF forecasts.

However, positive developments, such as a decrease in inflation to 6.9 per cent in September, the lowest in three years, have created a conducive environment for investment. This decline from 9.6 per cent in August signals improved purchasing power and consumer sentiment.

Local investor confidence has surged as the PSX begins its upward trajectory following the securing of the IMF loan. Uzair Younus, an economist, emphasizes that the strong backing from institutional investors, combined with a renewed focus on economic reforms, has created an atmosphere ripe for market growth.

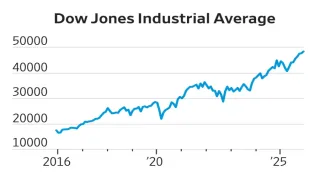

The Global Context

In contrast to the robust performance of the PSX, global markets have faced significant headwinds. For instance, the Nifty index in India has been on a downward trend, closing at its lowest point in over two months due to various factors, including geopolitical tensions and rising dollar strength. The contrasting performances of Pakistan's stock market and its regional counterparts underscore the unique situation in Pakistan.

While the Pakistan Stock Exchange has demonstrated remarkable resilience and growth amid a challenging economic landscape, it is crucial to maintain a balanced perspective. The current rally is driven by a combination of external support, favourable market conditions, and investor sentiment. However, the underlying economic challenges remain, necessitating careful monitoring of future developments.

Also Read: Top 15 Sharekhan Stock Picks for Diwali 2024: Do not Miss Out