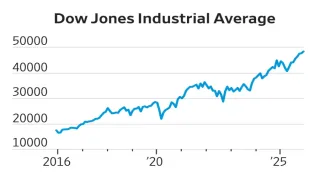

As Diwali approaches, stock markets often see a surge in investor enthusiasm, with festive cheer extending to portfolio decisions. This season, leading brokerages like HDFC Securities, JM Financial, Sharekhan, and others spotlight their top stock picks, selecting companies primed for strong returns. Among them, Reliance Industries (RIL), State Bank of India (SBI), Mphasis, Jyothy Labs, and NCC Ltd have emerged as the favourites. Let’s explore why these stocks have captured attention and what fuels analyst optimism for potential gains through the year.

1. Reliance Industries (RIL)

Backed by HDFC Securities, JM Financial, Sharekhan, and 5paisa, RIL’s diversified growth in telecom, retail, and new energy ventures makes it a formidable pick. Analysts have set ambitious target prices, ranging from Rs 3,243 (HDFC Securities) to Rs 3,500 (JM Financial), citing an estimated 15% CAGR in profits up to FY27. RIL's forward-looking strategies in green energy and digitalization keep it well-positioned, though high capex requirements and natural gas pricing fluctuations are noted as risk factors.

2. State Bank of India (SBI)

With endorsements from Religare, Kedia Advisory, HDFC Securities, and 5paisa, SBI has strong support for its resilience in India’s expanding banking sector. The technical analysis places SBI stock with a target range of Rs 915 to Rs 1,240, indicating a potential 20-55% growth. Its stability around the 200-day EMA and steady earnings projections make it attractive, especially as banking remains pivotal to India’s economic landscape.

3. Mphasis

Mphasis, supported by Phillip Capital, 5paisa, and Anand Rathi, is a popular Diwali pick within the IT sector. With bullish patterns emerging and favourable momentum in the digital transformation space, analysts have set target prices between Rs 3,560 (5paisa) and Rs 4,400 (Phillip Capital). Mphasis’s focus on cloud, automation, and AI solutions makes it an appealing choice for those seeking long-term tech sector exposure.

4. Jyothy Labs

Endorsed by Angel One, HDFC Securities, and Religare, Jyothy Labs is capturing interest with its diverse product range and transformation. Analysts forecast a revenue CAGR of over 12% through FY26, with target prices from Rs 600 (HDFC Securities) to Rs 680 (Angel One). The company’s efforts to strengthen margins and revitalize its product mix have made it an attractive pick in the FMCG sector, catering to both urban and rural demands.

5. NCC Ltd

A leading construction pick, NCC Ltd is supported by ICICIdirect, Angel One, and HDFC Securities. Analysts expect robust growth in India’s infrastructure push, assigning target prices from Rs 363 (HDFC Securities) to Rs 400 (Angel One). NCC’s diversified order book and projected revenue CAGR of 16% through FY27 position it as a strong performer in the construction sector. Its involvement in national projects and infrastructure diversity underscores its growth potential.

Also Read: Waaree Energies shares slip 9 percent after stellar 66 percent listing gain