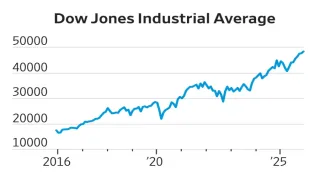

As the festive season of Diwali 2024 approaches, Sharekhan has released its list of top stock recommendations, covering a balanced mix of large-cap and mid-cap companies. With markets experiencing volatility due to global and domestic challenges, these stocks have been handpicked for their strong potential to generate returns.

For Samvat 2081, Sharekhan’s Diwali picks include companies from diverse sectors such as telecom, finance, FMCG, real estate, and capital goods. Notable companies like Bharti Airtel, Bajaj Finserv, and Reliance Industries stand out for their resilience and growth prospects despite market fluctuations.

Let’s take a closer look at Sharekhan's top picks for Diwali 2024.

Sharekhan’s Stock Picks for Diwali 2024

1. Dabur India

Dabur, a leading FMCG company, reported revenues of over Rs. 12,000 crore in FY2024. The company is well-positioned to benefit from the revival of rural demand and its strong product portfolio. Dabur is focused on market share gains, distribution expansion, and new product launches. With mid-teens earnings growth targeted for FY24-26, the current stock price, down ~16% from its recent high, offers a good entry opportunity.

CMP: Rs. 571

2. Dee Development Engineers

Dee Development provides specialized process piping solutions to industries such as oil, gas, and power. The company is increasing its manufacturing capacity to capitalize on the capital expenditure revival in these sectors. Strong order inflows are expected from Q4 FY2025, supported by government initiatives in energy.

CMP: Rs. 251

3. Hi-Tech Pipes

Hi-Tech is on track to achieve a 1-MTPA capacity by FY2025, with plans for further expansion to 2 MTPA over the next 3-4 years. The company benefits from early access to solar projects and improved steel prices. The stock trades at attractive P/E multiples, reflecting a strong projected PAT CAGR for FY2024-2027.

CMP: Rs. 185

4. HUDCO

HUDCO is poised to deliver a healthy book value CAGR of ~17%, driven by earnings growth and government support for affordable housing. The recent change to an NBFC – Infrastructure Finance Company status allows HUDCO to finance a broader range of projects, enhancing its growth potential. Its low-risk portfolio, with most exposure government-guaranteed, provides an additional safety net.

CMP: Rs. 215

5. Larsen & Toubro (L&T)

L&T is targeting 10% growth in order inflows and a 15% revenue increase for FY2025. With a record-high order book, the company is well-positioned to benefit from opportunities in both domestic and international markets.

CMP: Rs. 3,576

6. Reliance Industries

Reliance’s revenues have remained stable, supported by higher oil-to-chemicals (O2C) sales and improved domestic product placements. Jio Platforms posted a 17.8% EBITDA growth due to a better subscriber mix, while Reliance Retail increased its EBITDA margin by 30 basis points. Despite challenges in the O2C business, the company continues to innovate and mitigate headwinds.

CMP: Rs. 2,718

7. State Bank of India (SBI)

SBI is well-positioned to benefit from India’s economic growth, boasting a robust balance sheet and improving operating metrics. The bank is expected to maintain a return on assets (ROA) of ~1%, with broad-based credit growth. Sharekhan maintains a Buy rating with a target price of Rs. 975.

CMP: Rs. 614

8. Sunteck Realty

Sunteck aims for a 30-35% pre-sales growth for FY2025, with a Rs. 5,000 crore project pipeline. The company’s GDV is estimated at Rs. 37,480 crore and is expected to grow to Rs. 60,000 crore in the next 2-3 years. Rental income is set to rise from Rs. 35 crore in FY2023 to Rs. 320 crore by FY2028.

CMP: Rs. 592

9. Tata Motors

Tata Motors is maintaining healthy EBITDA margins in its JLR segment, with positive cash flow and an 8.5%+ EBIT margin target for FY2025. The company’s domestic passenger vehicle market share increased from 5% to 13.3% in H1FY2025, driven by strong demand and strategic initiatives.

CMP: Rs. 910

10. Mastek

Mastek focuses on enterprise digital and cloud transformation. The company is expanding its presence in the UK’s public sector and has opportunities in the North American healthcare industry. Partnerships with Salesforce and Snowflake are expected to drive growth.

CMP: Rs. 3,018

11. Allied Blenders & Distillers

Allied Blenders & Distillers has significantly reduced its debt, repaying approximately Rs. 800 crore using IPO proceeds. The company’s working capital debt now stands at Rs. 325 crore with a lower interest rate of 8.5%, down from 10-10.5%. Interest costs are expected to halve in FY2025, boosting profitability.

CMP: Rs. 332

12. Bajaj Finserv

Bajaj Finserv's new businesses—Bajaj Finserv AMC, Bajaj Securities, and Bajaj Finserv Health—offer long-term growth potential. Its lending business continues to outperform the industry, and the general insurance segment is experiencing healthy growth. The life insurance arm is also well-positioned for market share gains amid regulatory changes. A Buy rating with a target price of Rs. 2,350 has been maintained.

CMP: Rs. 1,821

13. Bharti Airtel

Bharti Airtel is a key player in India and Africa’s telecom sectors. With increasing smartphone penetration and growing data consumption, the company is well-positioned to benefit from 5G adoption. Recent tariff hikes are expected to boost ARPU and profitability, while capital expenditure moderation will help reduce debt.

CMP: Rs. 1,707

14. Caplin Point Laboratories

Caplin Point is expanding into larger markets such as Mexico, Colombia, and Chile, with a capital expenditure plan of Rs. 650-700 crore, of which Rs. 500 crore has already been spent. The stock is currently trading at around 27x and 23x its FY25E and FY26E EPS estimates, offering potential upside.

CMP: Rs. 1,926

15. Tata Consultancy Services (TCS)

TCS continues to lead in IT services with strong demand for digital transformation projects. The company’s diverse portfolio of services, global presence, and steady client base position it well for consistent growth.

CMP: Rs. 3,680

Also Read: Unlock 2024: Top Stock Market Sectors You Can Not Afford to Miss