Oil prices witnessed a notable increase of 2% on Thursday, driven by growing concerns surrounding potential disruptions to crude oil shipments amid escalating conflicts in the Middle East. As global markets reacted to these developments, Brent crude reached $75.42 per barrel, with U.S. West Texas Intermediate (WTI) following suit at $71.68 per barrel. This article explores the factors contributing to the recent price surge and examines the broader implications for the global oil market.

The Surge in Oil Prices

By 1211 GMT, Brent crude futures rose by $1.52, or 2.06%, while WTI futures climbed $1.58, equating to a 2.25% increase. These fluctuations highlight the significant volatility currently influencing the oil market. In the past two days, crude oil prices have surged over 5% due to heightened tensions in the Middle East, particularly following Iran's missile attacks on Israel.

The recent airstrikes conducted by Israel on Beirut and the ongoing threats between Israel and Iran have intensified fears of further conflict, which could disrupt vital oil supplies. Rahul Kalantri, VP of Commodities at Mehta Equities, pointed out that "crude oil has exhibited significant volatility," emphasizing the market's sensitivity to geopolitical developments.

Israel's Threat of Retaliation: Israeli Prime Minister Benjamin Netanyahu has openly warned Iran of potential consequences for its aggressive actions. This threat raises concerns about a possible Israeli strike on Iranian oil facilities, a scenario that could severely impact the supply chain in the region.

Iran's Warning: In response to Israel's actions, Tehran cautioned that any retaliation would result in "vast destruction," further escalating the tension and uncertainty surrounding Middle Eastern oil supplies. The Strait of Hormuz, a critical passage for approximately 20% of the world's daily oil supply, remains a focal point in these discussions, heightening concerns about its security.

Despite the geopolitical turmoil, there are glimmers of hope for stability in the oil market. OPEC+ recently concluded its meetings, reaffirming its strategy to increase output starting in December. This decision reflects the organization's commitment to maintaining balance in the oil supply and supporting prices amidst rising geopolitical tensions.

Additionally, reports from the U.S. Energy Information Administration (EIA) indicated an unexpected rise in crude oil inventories. The data revealed a 3.9 million barrel increase, contrary to market expectations of a 1.5 million barrel decline. This increase in U.S. stockpiles has tempered immediate gains in crude oil prices and provided a counterbalance to the unrest in the Middle East.

Factors Driving the Oil Price

- Geopolitical Instability: Ongoing conflicts and military actions in the Middle East have created a climate of uncertainty, leading investors to react swiftly to any developments that could threaten oil supplies.

- Potential Supply Disruptions: The looming threat of Israeli strikes on Iranian oil infrastructure raises concerns about potential supply disruptions, which could further strain global oil markets.

- OPEC's Production Capacity: OPEC's ability to increase production offers some reassurance to the market, suggesting that any shortfalls from Iran could be mitigated. Their commitment to boosting output from December signals confidence in managing supply despite regional tensions.

- U.S. Inventory Levels: The increase in U.S. crude oil inventories serves as a buffer against price hikes, providing some stability in the market amid fears of supply interruptions.

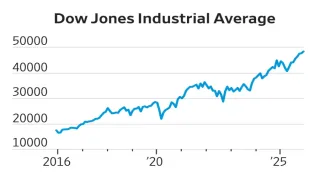

As investors navigate the complexities of the oil market, it is essential to consider both geopolitical factors and market fundamentals. While the current rise in oil prices is driven by concerns over Middle Eastern supply disruptions, the presence of adequate global production capacity could mitigate some of these risks.

Analysts anticipate that oil prices will remain volatile in the short term, influenced by developments in the Middle East and OPEC's production strategies. The ongoing situation underscores the interconnectedness of geopolitical events and global oil markets, making it imperative for investors to stay informed about potential shifts in supply and demand dynamics.

The recent increase in oil prices reflects a complex interplay of geopolitical tensions and market fundamentals. As Brent crude reaches $75.42 per barrel, the situation in the Middle East remains a critical factor influencing investor sentiment. With OPEC's commitment to increasing production and the unexpected rise in U.S. inventories, some elements may stabilize prices in the long run. However, as tensions continue to escalate, the market will likely remain on edge, responding to new developments and the potential for supply disruptions.

Also Read: Why Share Market Fall Today : Why did the stock market fall so much?