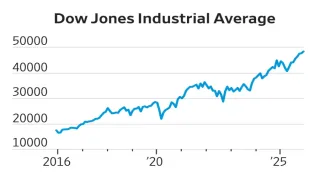

As Microsoft consistently delivers remarkable earnings, investors are analyzing whether its stock remains an attractive buy or if it’s currently fairly valued. Key financial metrics, impressive AI growth, and a strong market position all play into this assessment.

Key Metrics and Valuation for Microsoft

- Fair Value Estimate: $490.00

- Morningstar Rating: 4 stars

- Economic Moat: Wide

- Uncertainty Rating: Medium

With a Morningstar rating of 4 stars and a fair value estimate of $490 per share, Microsoft’s stock appears undervalued. This estimate implies a fiscal 2025 enterprise value-to-sales multiple of 13 and an adjusted price-to-earnings ratio of 38, making the stock attractive, particularly for long-term investors.

Q1 Earnings Highlights

In its recent Q1 earnings, Microsoft reported strong performance, driven by surging demand for artificial intelligence and its Azure cloud platform. The revenue for the quarter grew by 16% year-over-year to $65.59 billion, exceeding the high-end guidance of $64.80 billion. Key areas like productivity and business processes saw a 13% increase, intelligent cloud grew by 21%, and personal computing rose 17%, all on a constant-currency basis. This performance reinforces Microsoft’s strategy of hybrid cloud proliferation, giving clients flexibility in moving to the cloud at their own pace.

Long-Term Fair Value and Growth Prospects

Microsoft’s fair value estimate of $490 reflects a positive outlook on revenue growth, with a projected five-year compound annual growth rate of around 13%, including the recent acquisition of Activision. Microsoft has overcome hurdles like the 2008 downturn, the decline of its mobile division, and the shift from traditional licensing to subscription models, positioning itself for growth in emerging sectors like AI and cloud computing.

Economic Moat and Competitive Edge

Morningstar assigns Microsoft a 'wide' economic moat, driven primarily by high switching costs and further bolstered by network effects and cost advantages. Microsoft’s integrated suite of products—from Azure to Office 365—creates a 'sticky' ecosystem that encourages customers to adopt more Microsoft products over time. This consolidation adds to its entrenchment in enterprise environments, where companies value the convenience of having multiple solutions from one provider. This dynamic strengthens Microsoft’s market position and supports its ability to earn returns above its cost of capital for at least the next two decades.

Financial Strength and Cash Flow

Microsoft’s balance sheet remains strong, with $76 billion in cash and equivalents as of June 2024, offset by $52 billion in debt, resulting in a net cash position of $24 billion. The company’s gross leverage is at 0.5 times fiscal 2024 EBITDA. With growing revenue, expanding margins, and a robust free cash flow margin averaging 30% over the last three years, Microsoft is well-positioned to fund future growth initiatives, especially in cloud and AI. This strong financial footing enables Microsoft to reinvest in growth while offering stability to shareholders.

Risks and Uncertainties

Microsoft’s 'medium' Morningstar Uncertainty Rating reflects risks tied to its market-leading products, including Windows OS, Office, and Server. As clients increasingly shift to the cloud, Microsoft faces pressure to grow cloud-based revenues faster than its legacy, on-premises offerings decline. Continued cloud adoption and the transition to Microsoft 365 are essential for mitigating this risk, though the shift to cloud-based solutions presents some volatility.

Pros and Cons of Microsoft Stock

MSFT Bulls Say:

- Microsoft’s dominance in the public cloud via Azure positions it well for future growth, as enterprises increasingly adopt hybrid and fully cloud-based infrastructures.

- Microsoft 365 continues to benefit from upselling, with premium subscription options adding to recurring revenue.

- Microsoft’s established market presence in OS and Office provides steady revenue to fund expansion in Azure and AI.

MSFT Bears Say:

- The shift to subscription models, especially in Office, is maturing, which could slow growth momentum in this sector.

- Microsoft’s absence in the mobile market limits its presence in a critical technology space.

- Azure, while growing, still faces strong competition from Amazon Web Services (AWS) and other cloud providers, which could constrain Microsoft’s market share growth.

Final Verdict: Buy, Sell, or Hold?

Given Microsoft’s solid earnings, undervalued rating at a fair value of $490, strong economic moat, and strategic growth initiatives, the stock appears to be a buy for long-term investors. While challenges in certain markets persist, the company’s strategic positioning in cloud and AI, along with its stable financial footing, suggests it can weather near-term headwinds.

Also Read: How the U.S. Elections Will Impact Indian Stock Market in 2024