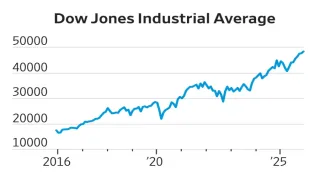

On Monday, US stocks experienced a slight downturn after initially opening higher. Investors are gearing up for a wave of economic data, including key figures on consumer price inflation.

By 9:45 a.m. ET, the Dow Jones Industrial Average had fallen 0.3%, reaching 39,374.38 points. The S&P 500 saw a drop of 0.2%, settling at 5,336.22 points, while the Nasdaq Composite decreased by 0.06%, landing at 16,734 points.

Earlier in the day, the Dow was up 0.02% at 39,500 points. The S&P 500 rose 0.24% to 5,356.23 points, and the Nasdaq Composite gained 0.45%, hitting 16,820 points.

This week’s economic calendar is packed with significant reports, including updates on inflation, retail sales, and industrial production. These reports will be crucial in shaping market expectations and providing insight into the overall economic climate.

The previous week saw a sharp decline in stock markets, driven by growing recession concerns in the US. This unease has kept investors on edge, influencing market movements.

Tesla’s shares dropped over 1%. Conversely, Starbucks saw a 3.5% increase in its stock price following news that activist investor Starboard Value is advocating for measures to enhance the company's stock performance. KeyCorp also saw a notable rise, with its stock climbing 15.3% after announcing a $2.8 billion investment from the Bank of Nova Scotia.

Bond Market Update

In the bond market, the yield on the 10-year Treasury bond edged up to 3.9% from 3.94% late on Friday. The 2-year Treasury yield also increased slightly, reaching 4.07% from 4.06%.

Gold and silver shine amid uncertainty

Gold prices reached a one-week high on Monday, driven by increased safe-haven demand as economic uncertainties loom. Spot gold climbed 0.9% to $2,453.77 per ounce by 1350 GMT. US gold futures also saw a rise, up 0.8% to $2,493.90. Spot silver advanced 1.4%, reaching $27.82 per ounce.

Oil Prices Continue Upward Trend

Oil prices continued to climb for the fifth consecutive session on Monday, fueled by concerns over supply risks in the Middle East. Brent crude futures increased by 88 cents, or 1.1%, to $80.54 per barrel by 1319 GMT. Meanwhile, US West Texas Intermediate crude futures rose by $1.06, or 1.38%, to $77.90 per barrel.

As the week progresses, investors will be watching closely for any new economic data that could impact market trends. The ongoing economic reports are likely to influence market dynamics and investor strategies in the near term.

Also Read: 5 Top Performing Sectors in the Past Month