On Tuesday, the Indian stock market is poised for a positive start, with domestic equity indices Sensex and Nifty 50 expected to open higher. This follows a global rebound led by gains in Asian markets and a strong performance by US stocks overnight. The global cues suggest that despite the volatility, markets are demonstrating resilience. Below, we dive into six key elements that influenced the market overnight, including insights on Gift Nifty, US stocks, and the much-anticipated Apple Event 2024.

1. Resilient Indian Stock Market Performance

On Monday, the Indian stock market indices rebounded with strength, closing higher due to buying in market heavyweights. The Sensex surged by 375.61 points (0.46%), ending at 81,559.54, while the Nifty 50 climbed 84.25 points (0.34%), settling at 24,936.40.

Siddhartha Khemka, Head of Research at Motilal Oswal Financial Services, remarked, “Despite global volatility, domestic equities have shown resilience at every decline, recovering by approximately 200 points from lower levels.” This consistent recovery is attributed to robust economic fundamentals and continued retail participation. While global policy meetings loom ahead, experts expect the market to continue its consolidation with a gradual upward movement.

2. Strong Rebound in Asian Markets

Asian markets traded higher on Tuesday, extending gains from Wall Street’s rebound. Japan’s Nikkei 225 rose 0.52%, while the Topix increased by 0.65%. South Korea’s Kospi and Kosdaq also gained 0.17% and 0.18% respectively. Hong Kong's Hang Seng index futures hinted at a higher opening, contributing to the positive sentiment across the region.

These developments reflect investor optimism fueled by upcoming trade data and improved market conditions, particularly in the technology and energy sectors.

3. Gift Nifty Indicates a Positive Start

Gift Nifty, a key indicator for Indian market performance, traded at around 25,040, reflecting a premium of 46 points compared to the previous close of Nifty futures. This signals a likely positive opening for Indian stock markets, bolstered by strong global cues. Investors are hopeful for continued upward momentum, backed by improving macros and increasing institutional participation.

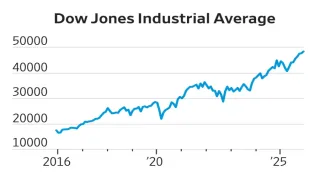

4. US Stocks Rebound After Last Week’s Decline

In a sharp reversal from last week’s decline, US stocks ended higher on Monday. The Dow Jones Industrial Average surged 484.18 points (1.20%) to 40,829.59, while the S&P 500 and Nasdaq Composite rallied 1.16% each, ending at 5,471.05 and 16,884.60 respectively.

Top performers included Nvidia, which rose by 3.5%, and Apple, which closed up by a modest 0.04%. Other major movers included Boeing (+3.4%), Palantir (+14%), and Dell Technologies (+3.8%). The strong performance of US tech and aerospace stocks has lifted overall investor sentiment.

5. Apple Event 2024

Apple held its much-anticipated Glow Time event on Monday, unveiling a series of exciting products and features. The tech giant introduced the iPhone 16 series, enhanced with artificial intelligence, along with the Apple Watch Series 10, Apple Watch Ultra 2, and an updated AirPods lineup. Apple also announced advancements in iOS 18, demonstrating the company’s continued focus on integrating AI into its ecosystem.

While Apple’s stock saw only a modest gain of 0.04%, the market is abuzz with anticipation over the commercial impact of these new products. Apple's ongoing innovation continues to reinforce its leadership in the global tech industry.

6. Steady Oil Prices and Stable Gold Market

In the commodities market, oil prices remained steady. Brent crude futures increased by 0.19%, trading at $71.98 a barrel, while US West Texas Intermediate (WTI) futures gained 0.15%, settling at $68.81 per barrel. Both benchmarks had rallied by approximately 1% during Monday’s settlement, reflecting a stable outlook for global energy demand.

Gold prices remained flat ahead of key US inflation data, which is expected to provide further insight into potential interest rate cuts by the Federal Reserve. Spot gold was steady at $2,504.98 per ounce, while US gold futures edged up by 0.1% to $2,533.70. Investors continue to monitor gold as a safe-haven asset amidst fluctuating inflation expectations.

The Indian stock market is expected to continue its upward momentum, buoyed by gains in global markets, particularly in the US and Asia. The resilience of domestic equities, as demonstrated by Monday’s rebound, is supported by strong economic fundamentals and continued retail participation. Investors are also keenly observing developments in US and European policy meetings, which are likely to have a significant impact on global market trends. Additionally, the technological innovations unveiled at Apple’s Glow Time event and the stability in oil and gold prices provide further support for market optimism in the coming days.

Also Read: Best Artificial Intelligence Stocks You Can Buy In India