The U.S. Presidential elections, scheduled for tomorrow, have the potential to shake up markets globally, including the Indian stock market. With Donald Trump and Kamala Harris both vying for the position, investors are keen to understand how the election outcomes will affect market sentiment. The U.S. election results, depending on which candidate emerges victorious, could trigger shifts in investor sentiment, foreign investments, and sector performance across the globe. The repercussions for the Indian market are critical, as it is closely tied to the economic health of the U.S.

Impact of a Republican Victory on Indian Markets

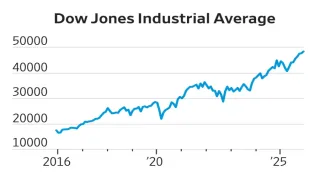

According to Gaurav Dua, Head of Capital Market Strategy at Sharekhan, a victory for the Republican candidate, Donald Trump, could initially spark a brief rally in Indian markets. Investors might respond positively to Trump’s potential pro-business policies, anticipating lower taxes, reduced regulations, and an overall boost to global markets. However, this optimism could quickly fade. The rise in U.S. bond yields and possible tariffs could lead to inflationary pressures that might affect emerging markets, including India. Additionally, a stronger dollar resulting from a Republican win could put pressure on Indian equities, pushing investors toward safer assets.

Dua cautions that such a rally would likely be short-lived. For investors in Indian markets, the best strategy would be to consider it as an opportunity for profit-taking rather than chasing further growth. With potential concerns around the U.S. economy’s policies, the long-term outlook for Indian markets could face challenges in the face of a more protectionist U.S. stance.

Conversely, G Chokkalingam, Founder and MD of Economics Research, believes that a win for Kamala Harris and the Democratic Party might bring more stability and global cooperation. While the election results could lead to some short-term market fluctuations, Chokkalingam emphasizes that the deep economic ties between the U.S. and India would likely cushion any adverse effects on Indian markets. India’s strong exports, particularly in IT services and goods, play a significant role in the U.S. economy, creating a “natural alliance” that won’t be disrupted by political shifts.

Even if the initial market reactions are volatile, Chokkalingam suggests that any dip in Indian equities should be viewed as a potential opportunity for long-term investors. He recommends focusing on small- and mid-cap stocks, which are likely to weather short-term volatility and offer long-term growth potential. India’s importance as a key trading partner to the U.S. makes it less likely that any election-related developments will lead to a major downturn in the Indian economy.

Which Sectors Will Weather Potential Volatility Best?

While the general market reaction remains uncertain, certain sectors are expected to fare better during times of political volatility. According to both experts, India’s technology sector, especially IT services, will likely remain strong. The U.S. dependence on Indian software and tech services means that even if U.S. policies shift, the underlying demand for Indian expertise will persist. Additionally, the pharmaceuticals, healthcare, and agriculture sectors are seen as defensive and may see less impact from election results.

Infrastructure and capital goods sectors, on the other hand, could experience more turbulence, as changes in U.S. trade policies and global supply chains may affect them. Export-driven sectors could also face headwinds if trade tariffs rise or the global economic environment becomes less favourable.

Short-Term Volatility or Long-Term Gains?

Both experts agree that, while the U.S. elections may trigger short-term volatility, the Indian stock market’s long-term trajectory is unlikely to be fundamentally altered by the outcome. Gaurav Dua warns that any rallies post-election should be treated with caution, while G Chokkalingam encourages investors to view potential market dips as buying opportunities for quality stocks.

In conclusion, the Indian market’s response to the U.S. elections is likely to be complex, with short-term fluctuations, but the long-term outlook remains largely unaffected. Investors should adopt a strategic approach, focusing on sectors with resilient growth prospects, such as IT services, pharmaceuticals, and agriculture, while considering potential opportunities in small- and mid-cap stocks for long-term gains. The outcome of the U.S. Presidential election may influence investor sentiment, but India’s deep economic ties with the U.S. offer a strong foundation for resilience in the Indian market.

Key Takeaways:

- Short-term market volatility is expected following the U.S. election results, with a brief rally possible under a Republican win.

- Democratic policies may provide more long-term stability, but market reactions will vary.

- IT, healthcare, and agriculture sectors are likely to perform well, while capital goods and export-driven sectors may face more pressure.

- Investors should view any market dips as buying opportunities for quality stocks, especially in the small- and mid-cap space.

Also Read: Top 5 Diwali Stocks 2024: Must-Buy Picks for Big Festive Gains