Investing $1,000 can be a meaningful step toward financial stability and growth, regardless of where you are in your financial journey. Here’s a summary of the key options to consider:

1. Build an Emergency Fund

Who it's for: Anyone without 3–6 months of living expenses saved.

Benefits: Provides financial security and peace of mind during unexpected events.

2. Pay Down Debt

Who it's for: Those with high-interest debt, especially credit cards.

Benefits: Avoid paying significant interest and improve cash flow.

Example: Paying off a $1,000 credit card debt with 20% APR saves hundreds in interest over time.

3. Contribute to Retirement Plans

Who it's for: People with long-term financial goals or access to employer-sponsored retirement accounts.

Benefits: Leverage compound growth and tax advantages.

- Maximize contributions to a 401(k), especially if there's an employer match.

- Open an IRA (traditional or Roth) with providers like Fidelity or Vanguard.

4. Open a Certificate of Deposit (CD)

Who it's for: Those seeking low-risk investments and can lock money away.

Benefits: Higher interest rates than savings accounts without market exposure.

Considerations: Choose a term length that aligns with your financial goals; longer terms usually offer better rates.

5. Invest in Money Market Funds

Who it's for: People who prefer low-risk, liquid investments with better yields than traditional savings accounts.

Benefits: Earn monthly dividends and access funds easily.

How to do it: Purchase through banks, brokers, or fund providers like Vanguard.

6. Buy Treasury Bills

Who it's for: Conservative investors who want guaranteed returns with minimal risk.

Benefits: Backed by the U.S. government; exempt from state income tax.

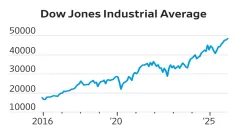

7. Invest in Stocks or Index Funds

Who it's for: Those with higher risk tolerance and a long-term investment horizon.

Benefits: Potential for high returns and portfolio diversification.

How to start:

- Use a brokerage account or apps like Robinhood or Webull.

- Explore index funds like S&P 500 ETFs for diversified exposure.

8. Use a Robo-Advisor

Who it's for: Beginners or busy investors who prefer automated solutions.

Benefits: Tailored portfolios, low fees, and hands-off investing.

Top options: Betterment, Wealthfront, or platforms like Schwab Intelligent Portfolios.

How to Choose the Best Option:

- Short-term goals: Build an emergency fund or pay off debt.

- Low risk/guaranteed returns: Consider high-yield savings, CDs, or Treasury bills.

- Long-term growth: Invest in retirement accounts, index funds, or through a robo-advisor.

- Flexibility needed: Money market funds provide liquidity with some yield.