The minimum average monthly balance (AMB) requirement might seem like a boring banking detail, until it costs you a few hundred rupees in penalty! In 2025, Indian banks have taken two distinct paths: Public sector banks, such as SBI, Bank of India, and PNB, have made life easier by removing AMB penalties altogether. Private sector banks, on the other hand, continue to maintain their AMB policies, some with high thresholds.

Whether you’re a college student with your first savings account or a corporate employee juggling multiple bank relationships, here’s a full bank-by-bank breakdown of AMB rules, penalties, and zero-balance options.

State Bank of India (SBI)

- Minimum Balance Requirement: Rs 0 (Zero balance for all savings accounts)

- Penalty for Non-Maintenance: None

- Highlight: SBI removed AMB penalties entirely, making it one of the most user-friendly banks for everyday customers. This applies to all regular savings accounts, not just special schemes.

Why choose SBI? No AMB worries, huge branch network, easy mobile banking. Ideal for retirees, students, and individuals living in rural areas.

Bank of India

- Minimum Balance Requirement: Rs 0

- Penalty for Non-Maintenance: None

- Highlight: Similar to SBI, Bank of India has done away with minimum balance requirements, giving customers stress-free account management.

Why choose Bank of India? It’s a PSU bank with nationwide reach, solid digital banking services, and complete freedom from AMB penalties.

Punajb National Bank (PNB)

- Minimum Balance Requirement: Rs 0

- Penalty for Non-Maintenance: None

- Highlight: PNB’s zero-balance approach ensures customers from all income groups can use savings accounts without hidden costs.

Why choose PNB? PNB offers competitive interest rates and a wide range of savings schemes without the fear of AMB charges.

Indian Bank

- Minimum Balance Requirement: Rs 0

- Penalty for Non-Maintenance: None

- Highlight: Indian Bank has aligned itself with other public sector banks by eliminating AMB requirements.

Why choose Indian Bank? Simple, transparent rules and strong rural presence make it a dependable choice.

Canara Bank

- Minimum Balance Requirement: Rs 0

- Penalty for Non-Maintenance: None

- Highlight: Canara Bank’s zero-balance policy reflects a customer-first approach.

Why choose Canara Bank? It offers a blend of traditional customer service with modern digital banking.

HDFC Bank

- Urban Branches: AMB of Rs 10,000 or an FD of Rs 1 lakh for at least 1 year 1 day.

- Semi-Urban Branches: AMB of Rs 5,000 or an FD of Rs 50,000 for at least 1 year 1 day.

- Rural Branches: AMB of Rs 2,500 or an FD of Rs 25,000 for at least 1 year 1 day.

Non-Maintenance Charges: 6% of the shortfall or Rs 600 (whichever is lower) for most accounts. Pragati Savings Account: Rs 150 maximum. GIGA Savings Account: Rs 600 maximum in metros, Rs 300 maximum in semi-urban/rural.

Why choose HDFC Bank? Premium services, excellent app, and multiple account types, but better for customers who can consistently maintain the required balance.

ICICI Bank

- Metro/Urban: Rs 50,000 AMB

- Semi-Urban: Rs 25,000 AMB

- Rural: Rs 10,000 AMB

Non-Maintenance Charges: 6% of shortfall or Rs 500, whichever is lower.

Special Waivers: No charges for pensioners. Family Banking lets you meet AMB collectively (1.5× program criteria). ‘Select’ program waives fees if you hold Rs 2 lakh in deposits or Rs 25 lakh across deposits, mutual funds, and demat holdings.

Why choose ICICI Bank? Best for customers using multiple banking products, relationship benefits can help avoid penalties.

Axis Bank

- Metro/Urban: No AMB requirement.

- Semi-Urban/Rural: Rs 10,000 AMB or an FD of Rs 50,000 for 12 months.

Non-Maintenance Charges: Rs 6 per Rs 100 shortfall or Rs 300 (semi-urban) / Rs 150 (rural).

Why choose Axis Bank? Urban customers can enjoy a no-AMB policy; rural customers get flexible FD-based AMB compliance.

Kotak Mahindra Bank

- 811 Zero Balance Account: Rs 0 AMB requirement.

- Other savings accounts: AMB from Rs 2,000 to Rs 1 lakh.

Non-Maintenance Charges: Kotak Classic: Max Rs 500. Kotak Pro: Max Rs 600. Kotak Edge: Max Rs 600. Kotak Nova: Max Rs 250. Kotak Sanman: Max Rs 100. Kotak Platina: Max Rs 600.

Why choose Kotak? The 811 account is perfect for zero-balance seekers, while premium accounts offer extra perks for those meeting higher AMB.

IndusInd Bank

- IndusInd Delite Account: Rs 0 AMB requirement.

- Other accounts: AMB ranges from Rs 1,500 to Rs 50,000 depending on branch location.

Non-Maintenance Charges: 6%-10% of shortfall (min Rs 150, max Rs 900).

Why choose IndusInd? Good mix of zero-balance and high-value accounts; fees can be steep for shortfalls.

IDFC FIRST Bank

- Diamond Private Savings Account: Rs 0 AMB.

- Other accounts: Rs 10,000-Rs 25,000 AMB.

Non-Maintenance Charges: 6% of shortfall or Rs 500 (whichever is lower).

Why choose IDFC FIRST Bank? Competitive interest rates on savings accounts, with flexible AMB structures.

Yes Bank

- PRO Max: Rs 50,000 AMB, max penalty Rs 1,000.

- Pro Plus / Essence / Respect SA: Rs 25,000 AMB, max penalty Rs 750.

- PRO: Rs 10,000 AMB, max penalty Rs 750.

- Savings Value / Kisan SA: Rs 5,000 AMB, max penalty Rs 500.

- My First YES: Rs 2,500 AMB, max penalty Rs 250.

Penalty Rates: If balance >50% of requirement: 5% of shortfall. If balance <50% of requirement: 10% of shortfall.

Why choose Yes Bank? Wide choice of account tiers; penalties are proportional to shortfall.

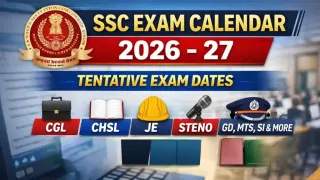

Also Read: Upcoming Govt Exams in India: Aug to Dec 2025 List