CEAT Limited’s shares surged 9% to a record high of ₹3,370 on December 9 following the announcement of its acquisition of Camso’s Off-Highway construction equipment bias tyre and tracks business from Michelin. The all-cash deal, valued at $225 million, is set to boost CEAT’s product portfolio in high-growth segments like agriculture tyres, harvester tracks, power sports tracks, and material handling solutions.

The acquisition marks a significant milestone in CEAT's journey to strengthen its foothold in the high-margin Off-Highway Tyres (OHT) market. By adding Camso’s products, CEAT can cater to the growing global demand for specialized tyres and tracks in the construction, agriculture, and sports sectors.

Brokerages Bullish on CEAT

Brokerages have responded positively to the acquisition:

- Axis Capital: Maintains a ‘Buy’ rating with a target price of ₹3,450, citing reasonable valuations at a 1x price-to-sales multiple, though integration challenges are noted.

- IIFL: Reiterated its ‘Buy’ rating, raising the target price to ₹4,000. It anticipates a 7-8% EPS accretion by FY26, praising the deal's profitability.

- Investec: Set a target price of ₹3,750, highlighting CEAT as a preferred pick in the tyre sector due to its accelerated growth potential in speciality tyres.

CEAT Financial Performance

Despite a 41.5% drop in consolidated net profit to ₹121.5 crore in Q2 FY24, CEAT posted an 8.2% increase in revenue to ₹3,304.5 crore, showing resilience in a competitive market.

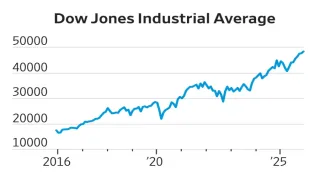

CEAT shares were trading at ₹3,334 at 9:20 AM on December 9, marking a 7.8% increase from the previous close. Year-to-date, the stock has rallied 28%, reflecting investor optimism and strong market positioning.

What’s Next for CEAT?

The acquisition positions CEAT for long-term growth in the Off-Highway Tyre segment. While challenges such as smooth integration remain, brokerages believe the deal solidifies CEAT's market leadership in high-margin categories.

With strong analyst endorsements, CEAT is set to accelerate growth, making it a stock to watch in the coming months.

Also Read: How Did Kernex Microsystems Land Rs 2,041.4 Cr Railway Deal?