When Finance Minister Nirmala Sitharaman rose to present the Union Budget 2026 on February 1, there was a familiar sense of anticipation among India’s middle class. Every Budget season, individual taxpayers look for two things above all else: relief and clarity. While Budget 2026 does not tinker with income tax slabs or rates, it quietly attempts something far more structural and long-lasting. This year’s Budget focuses on simplification, predictability, and easing long-standing pain points that ordinary taxpayers have faced for decades.

Instead of headline-grabbing tax cuts, the government has chosen a calmer, reform-driven approach. The emphasis is on smoother compliance, cleaner processes, fewer human touchpoints, and a tax system that feels less intimidating to first-time and small taxpayers. At the heart of this transformation is a major legislative shift: the replacement of the six-decade-old Income Tax Act, 1961, with the new Income Tax Act, 2025, which will come into force from April 1, 2026.

For individual taxpayers, salaried professionals, small business owners, NRIs, overseas investors, and even students studying abroad, Budget 2026 carries several meaningful changes. These reforms may not immediately inflate your monthly take-home salary, but they aim to reduce confusion, delays, and compliance fatigue over the long term. In many ways, this Budget is less about instant gratification and more about building a tax ecosystem that works quietly and efficiently in the background.

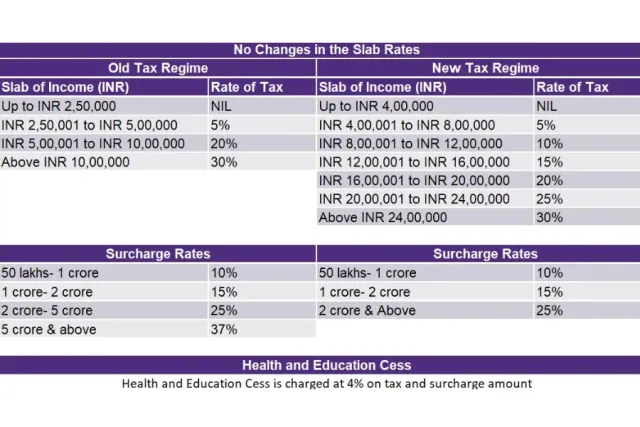

Income tax rates remain unchanged in Budget 2026

One of the first things taxpayers notice in any Budget is whether income tax slabs have changed. In Budget 2026, the government has chosen stability over surprise. The income tax slab rates under both the old and new tax regimes remain the same. There are no changes to surcharge rates, and the education cess continues unchanged as well.

This decision signals a broader policy intent. Instead of frequent tinkering with rates, the government appears focused on improving compliance and widening the tax base through better systems and clearer laws. For taxpayers, this means predictability. Financial planning for the coming year becomes easier when tax rates are not constantly shifting. Salaried individuals, in particular, can structure investments, insurance, and savings without worrying about last-minute rule changes.

While some taxpayers may feel disappointed by the absence of direct tax relief, the unchanged rates also mean there are no hidden surprises. What you paid last year is broadly what you will pay this year, provided your income structure remains the same.

Income Tax Act 2025 to replace old tax law

Perhaps the most significant announcement in Budget 2026 is the confirmation that the Income Tax Act, 1961, will finally be replaced. The Finance Minister reminded Parliament that a comprehensive review of the existing law was announced in July 2024 and has now been completed in record time. The new Income Tax Act, 2025, will be implemented from April 1, 2026.

This is not merely a cosmetic rewrite. The existing tax law has accumulated layers of amendments, explanations, provisos, and exceptions over decades. For ordinary citizens, this made tax compliance feel like decoding a legal textbook. The new Act aims to simplify language, reduce cross-references, and present rules in a more logical, user-friendly manner.

Equally important is the redesign of Income Tax Rules and Forms. According to the Finance Minister, these will be notified shortly, giving taxpayers adequate time to understand and adapt. The redesigned forms are meant to ensure that even ordinary citizens without professional assistance can comply without difficulty. This is a crucial step towards democratizing tax compliance in India.

New income tax return filing deadlines

One of the most practical changes introduced in Budget 2026 relates to income tax return filing timelines. For years, taxpayers have struggled with tight deadlines, delayed data from employers or banks, and last-minute portal congestion. The revised timelines aim to reduce this pressure.

Individuals filing simpler returns such as ITR-1 and ITR-2 will continue to have a deadline of July 31, maintaining continuity for salaried taxpayers and pensioners. However, for non-audit business cases and trusts, the return filing deadline has now been extended to August 31. This additional month can make a meaningful difference for small business owners who often juggle multiple compliance requirements.

The window for revising returns has also been extended. Previously, revised returns could be filed only up to December 31. Under the new framework, taxpayers will be allowed to revise returns until March 31, subject to payment of a nominal fee. This change acknowledges a simple reality: genuine mistakes happen, and taxpayers should have a fair opportunity to correct them without fear or panic.

Lower TCS rates on foreign travel and remittances

Budget 2026 brings welcome relief for individuals spending money abroad, whether for travel, education, or medical treatment. Tax Collected at Source on overseas tour packages has been rationalised to a flat 2 per cent, replacing the earlier structure where rates ranged from 5 per cent to as high as 20 per cent depending on the amount spent.

This move significantly reduces the upfront cash flow burden on travellers. Earlier, high TCS rates meant that a large sum was blocked until taxpayers claimed refunds. The new flat rate simplifies calculations and reduces refund-related delays.

Similarly, TCS on remittances under the Liberalised Remittance Scheme for self-funded foreign education and overseas medical treatment has been reduced from 5 per cent to 2 per cent. This change directly benefits students and families dealing with substantial education expenses, as well as individuals seeking medical treatment abroad.

Tax relief measures for small taxpayers

Small taxpayers often face disproportionate compliance hurdles, especially when applying for nil or lower TDS certificates. Until now, this process involved applications, follow-ups, and interaction with tax officers, leading to delays and uncertainty.

Budget 2026 proposes a fully automated, rule-based approval mechanism for such certificates. By replacing manual processes with system-driven approvals, the government aims to reduce discretion and improve transparency. For small taxpayers with predictable income patterns, this change can significantly ease cash flow pressures and reduce administrative stress.

This reform also aligns with the broader goal of minimising human interface in tax administration, thereby reducing scope for errors and disputes.

TDS clarity for manpower and staffing services

Ambiguity in tax provisions often leads to disputes, and manpower services have long been one such grey area. Budget 2026 provides much-needed clarity by explicitly categorising manpower services under payments to contractors for TDS purposes.

With this clarification, TDS on manpower services will be charged at either 1 per cent or 2 per cent, depending on the nature of the payment. This removes confusion for businesses and service providers alike and ensures consistent compliance across sectors.

For professionals and companies engaged in staffing and manpower supply, this clarity helps in accurate pricing, invoicing, and tax planning.

Form 15G and 15H filing made easier

Investors holding securities across multiple companies often face repetitive paperwork, particularly when submitting Form 15G or Form 15H to avoid excess TDS. Budget 2026 introduces a practical solution by allowing depositories to collect these forms from investors and submit them directly to the respective companies.

This centralised approach reduces duplication, minimises errors, and saves time for investors, especially senior citizens who rely heavily on Form 15H. It also improves compliance efficiency for companies and reduces administrative overhead.

One-time foreign asset disclosure scheme details

Foreign asset disclosure has been a complex and intimidating area for many taxpayers, especially students, young professionals, and individuals who have lived or worked abroad. Recognising these challenges, Budget 2026 introduces a one-time, six-month foreign asset disclosure scheme.

The scheme is divided into two categories. Category A covers taxpayers who failed to disclose overseas income or assets valued up to one crore rupees. These individuals can regularise their status by paying 30 per cent tax on the fair market value of the asset or undisclosed income, along with an additional 30 percent in lieu of penalty. In return, they receive immunity from prosecution.

Category B applies to taxpayers who paid due tax on overseas income but failed to declare the associated foreign asset, with asset value up to five crore rupees. Such taxpayers can regularise their position by paying a fee of one lakh rupees and receive immunity from both penalty and prosecution.

Additionally, individuals who did not disclose foreign non-immovable assets valued below twenty lakh rupees will receive immunity from prosecution with retrospective effect from October 1, 2024. This provision offers significant relief to those who made genuine disclosure errors without malicious intent.

Higher equity investment limits for overseas investors

To make Indian capital markets more accessible, Budget 2026 allows persons resident outside India to invest in listed Indian equities through the Portfolio Investment Scheme. The individual investment limit has been raised from 5 per cent to 10 per cent, while the overall cap has been increased from 10 per cent to 24 per cent.

This change is expected to attract more foreign participation in Indian markets, deepen liquidity, and strengthen investor confidence. For overseas Indians and foreign investors, the relaxed limits offer greater flexibility and opportunity.

Simpler TDS process for NRI property sales

Property transactions involving non-residents often involve complex compliance requirements, particularly around TDS. Budget 2026 simplifies this process by allowing resident buyers to deduct and deposit TDS using a PAN-based challan, eliminating the need for a TAN.

This change reduces procedural hurdles, speeds up transactions, and makes compliance more accessible for individuals who may not be familiar with tax registration processes.

Tax exemption to attract global experts to India

In a move aimed at positioning India as a global talent hub, Budget 2026 grants an exemption on foreign-sourced income for experts visiting India for up to five years. To qualify, individuals must have been non-residents for the preceding five years and must provide services under a government-notified scheme, among other conditions.

This measure is designed to attract high-quality expertise in critical sectors, promote knowledge transfer, and strengthen India’s global competitiveness.

What Union Budget 2026 means for taxpayers?

Union Budget 2026 may not be remembered for dramatic tax cuts, but it stands out for its emphasis on structural reform. By focusing on simplification, automation, and clarity, the government is signalling a shift from short-term relief to long-term efficiency.

For individual taxpayers, the real benefit lies in reduced friction. Easier filing, clearer rules, fewer compliance bottlenecks, and fair opportunities to correct past mistakes collectively create a tax environment that feels more humane and predictable.

As the new Income Tax Act, 2025, comes into force from April 2026, taxpayers have a crucial year ahead to understand, adapt, and plan. Budget 2026 sets the stage for that transition, offering stability today and simplicity tomorrow.

Also Read: UPPSC Exam Calendar 2026-27 Released, PCS Prelims Dec 6