An investor cannot immediately buy or sell shares on a stock exchange. Officially acknowledged participants in a stock market are stock brokers. They trade to invest. They are either independent service providers or employees of a broking firm. They possess the requisite training and job experience in the banking sector. A broker is sometimes known as a trading member while discussing the stock market.

You may trust a stock broker's judgement and experience since they know the market's etiquette. They might assist you in making informed choices at the store.

What is the stock market?

Equities, also referred to as stocks, are securities that provide holders with an ownership stake in a publicly traded corporation. It's a true investment in the company, and you influence how it runs if you hold the majority of its shares. The collection of equities that the general public may purchase and sell on various exchanges is referred to as the stock market.

From when does stock originate? Stock is issued by publicly traded firms to raise money for their operations. Those stock issues are purchased by investors who believe the company will grow in the future. In addition to any dividends, owners get an increase in the share price. If the business runs out of money, they may also see their investment decrease or vanish completely.

Shareholders can sell their company's shares to buyers on the stock market, which functions as a sort of aftermarket. On a stock exchange, such as the Nasdaq or the New York Stock Exchange, this trading occurs. Almost all trading today happens electronically, as opposed to the old days when traders would physically visit the market floor to make deals.

Which Should Beginners Invest in Short-Term or Long-Term?

Understanding the investment horizon—the amount of time one is willing to keep onto investments—is one of the most perplexing parts of stock trading for novices. There are usually two time periods for investments: short-term and long-term. The distinction between the two is as follows:

- Short-term investment benefits: Short-term investments are made by investors who plan to sell their shares within three to four months after purchase. In a bull market, they let you profit quickly and keep the gains for your gain. In this case, investors can profit from the stock market without having to retain their money for an extended period if the assets' prices rise.

- Advantages of long-term investment: Buying stocks to hold them for several years is known as long-term investment or value investing. Investing for the long term guarantees that you reduce stock market risks as they accumulate over time. Due to the longer time horizon and increased possibility of higher gains, these investments provide investors with the highest value in securities.

- Which investment kind is best for beginners? Both, depending on the investment objective, are excellent. Short-term investments are a good option if you have a high-risk tolerance and want to generate rapid returns without holding onto your money for a long time.

On the other hand, value investing is an option for individuals who want to make methodical long-term investments rather than taking on significant risks. But if you're just starting, a combination of the two may be the best way to learn about the share market.

1. Choosing the Right Investment

Picking the right stock isn’t as simple as it seems. While it’s easy to spot past high performers, predicting future success is much harder. Successful stock investing requires thorough analysis and management. Dan Keady, CFP, of TIAA, warns that individual investors face a tough challenge against professionals who rigorously analyze companies.

To evaluate a company, delve into fundamentals like earnings per share (EPS) and price-earnings (P/E) ratio. Assess the management team, competitive advantages, and financial statements. Buying stock in a beloved brand isn’t a sound strategy, and past performance doesn’t guarantee future results.

2. Beginners Should Avoid Individual Stocks

While stories of stock market wins are enticing, they often overshadow losses. Unrealistic expectations and confusing luck with skill can lead to disappointment. Tony Madsen, CFP, suggests that novices are unlikely to outperform market professionals. Instead, consider index funds or ETFs, which offer diversification and lower risk.

3. Build a Diversified Portfolio

Index funds offer instant diversification. A fund based on the S&P 500, for instance, includes hundreds of companies across various industries, reducing the impact of any single stock on your portfolio. This diversification enhances overall returns and mitigates risk. For simplicity, mutual funds or ETFs are ideal for creating a broad portfolio without extensive company analysis.

4. Brace for Downturns

Market fluctuations are inevitable, and handling losses can be challenging. Diversifying your portfolio limits the impact of any single stock. Even with index funds, expect some volatility. Madsen advises preparing for downturns and staying invested despite short-term fluctuations to achieve long-term gains.

5. Practice with a Stock Market Simulator

Simulators allow you to experience investing without risking real money. They help temper the belief that you can consistently outsmart the market. Keady recommends using simulators to understand market dynamics before committing to real funds.

6. Commit to Long-Term Investing

Investing is a long-term endeavour, and daily market news can be overwhelming. Developing patience and minimizing portfolio checks can help manage emotions. Set a schedule for portfolio reviews to avoid impulsive decisions during market volatility.

7. Start Investing Now

Timing the market perfectly is impossible. Investing is about long-term commitment, so start now. Compounding returns over time can significantly enhance your results. Establish a regular savings and investment plan to achieve your financial goals.

Not sure what step zero is before getting started with investing? Not confident about your overall grasp of financial literacy? Check out Finelo — the award-nominated online learning platform dedicated to making learning accessible, results-driven, and actually fun for its users. With over a million happy learners, Finelo is the go-to platform for mastering investing basics before diving into the markets

8. Avoid Short-Term Trading

Short-term trading often leads to unrealistic expectations and potential losses. High-powered investors and algorithms dominate the market, making it tough for novices to succeed. For goals within a few years, low-risk options like high-yield savings accounts or CDs are better. Invest in the stock market only if you can commit for at least three to five years.

9. Keep Investing Consistently

Building wealth requires ongoing investment. Regularly add to your investments, similar to a 401(k) plan, to grow your portfolio. Automated investments can help maintain discipline and remove emotions from the process.

Understanding the Stock Market

The stock market is a platform for exchanging stocks for money. Investors buy stocks expecting their value to rise, while sellers may expect a decline. The market evaluates companies based on business results and prospects, with stock prices reflecting supply and demand dynamics.

Private firms may sell stocks through IPOs to raise funds, allowing investors to buy and trade shares. Stock prices are influenced by expectations of a company’s future performance, making the market forward-looking.

Risks and Rewards of Stock Investing

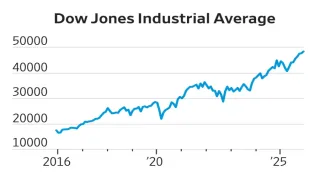

Stocks offer ownership in top companies and can be highly profitable. Historically, the S&P 500 has returned about 10% annually, including dividends. Long-term investors benefit from tax advantages, as gains are only taxed upon sale.

However, not all stocks perform well. Some may go bankrupt, resulting in total losses. Successful stocks like Amazon and Apple can yield substantial returns, but finding such winners requires skill and knowledge.

Two Ways to Win:

- Index Funds: Buy and hold an index fund like the S&P 500 for a long-term average return.

- Individual Stocks: Identify and invest in high-performing stocks, though this is riskier and demands expertise.

Also Read: Dream 11 Predictions for all matches of Tamilnadu Premier League