India’s stock markets faced a significant downturn today, with both the Nifty and Sensex indices plummeting by approximately 2%. This sharp decline has left investors and analysts scrambling to understand the underlying causes and potential implications for the future. In this article, we will delve into the top seven reasons for this market drop and what investors can expect in the coming days.

1. Global Market Sentiment

The global market sentiment has been considerably shaky, primarily due to rising inflation rates in major economies such as the United States and the Eurozone. As inflation continues to surge, investors are increasingly concerned that central banks may feel pressured to raise interest rates to combat this economic challenge. The fear of tightening monetary policy has led to a widespread sell-off in equities across the globe, significantly impacting Indian markets. This connection underscores how global economic conditions can reverberate through local stock markets, leading to heightened volatility.

2. Rising Oil Prices

Crude oil prices surged past $90 per barrel, driven by geopolitical tensions and production cuts orchestrated by OPEC+. Higher oil prices historically lead to increased inflation, which can have dire implications for economic growth. India, being heavily reliant on oil imports, is acutely affected by these rising prices. The impact is felt both at the consumer level, with increased costs of living, and at the corporate level, where profit margins may be squeezed. This scenario creates a ripple effect, negatively influencing investor sentiment and further exacerbating market downturns.

3. Weak Corporate Earnings

Recent earnings reports from several major corporations have revealed disappointing results that have caught many by surprise. Analysts had anticipated stronger performances, particularly in key sectors. However, many firms reported lower-than-expected revenues and profits, leading to a loss of confidence among investors. This decline in corporate earnings raises red flags regarding future growth prospects, prompting investors to reevaluate their positions and contribute to the overall market slump.

4. Foreign Institutional Investors (FIIs) Selling

A notable trend has emerged, with foreign institutional investors pulling out substantial amounts from Indian equities. The net selling by FIIs has reached alarming levels, creating considerable downward pressure on stock prices. This behaviour is often perceived as a signal of declining investor confidence in the Indian market. When foreign investors withdraw, it can lead to increased volatility and further exacerbate the prevailing bearish sentiment among domestic investors.

5. Domestic Economic Concerns

Recent economic indicators suggest that growth in India may be slowing down. Data released regarding the manufacturing and services sectors has shown signs of contraction, raising concerns about the overall health of the economy. Investors are now wary of potential policy changes that could further destabilize economic conditions. The combination of slowing growth and uncertainty regarding future policies contributes to an environment of heightened caution among investors, leading to sell-offs in the stock market.

6. Political Uncertainty

Political developments, including upcoming elections and potential policy reforms, have injected a degree of uncertainty into the market. Concerns regarding potential changes in government policies or leadership can lead to increased volatility in the stock market, as investors reassess their positions in light of possible future changes. This uncertainty often causes investors to adopt a more cautious approach, further contributing to market downturns.

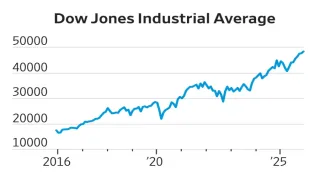

7. Technical Corrections

After a prolonged period of gains, the markets were due for a technical correction. Many analysts believe that the recent highs were unsustainable, prompting this pullback as a natural response to overvaluation in certain sectors. Technical indicators suggested that a correction was overdue, which may have prompted some investors to sell off their holdings. This phenomenon highlights the cyclical nature of stock markets, where periods of growth are often followed by corrections to realign valuations with fundamental conditions.

What to Expect Tomorrow

Looking ahead, analysts suggest that market volatility may persist as investors digest these developments. The upcoming economic data releases will be closely monitored for signs of recovery or further decline. Investors should pay attention to indicators such as inflation rates, employment figures, and corporate earnings announcements, as these will significantly influence market sentiment.

Additionally, any news regarding global economic conditions or fluctuations in oil prices will likely play a crucial role in shaping market movements. The interplay between domestic and global factors will be pivotal in determining whether the markets can regain stability or continue to face downward pressure.

Also Read: Bajaj Housing Finance IPO Allotment Status: Check Your Shares Now